Market Efficiency and Policy Trade-offs

Governments pursue policies for a variety of reasons. They provide public goods, such as free education and national defense. Governments also implement regulations meant to correct a variety of market failures, such as externalities and imperfect competition (e.g. monopolies). In order to implement its policies, a government needs to raise revenue to pay for its programs.

We have seen that levying taxes can distort a market's equilibrium. This distortion affects society's welfare through a cost called the deadweight loss. This page introduces this idea and formalizes the cost from taxation. This way when policymakers are deciding whether the benefits of a program justify its implementation, there can be a full accounting of the costs.

Market Efficiency

The essence of economics is that resources are scarce and societies must decide on how to allocate them across its members. Under most circumstances, markets turn out to be the most efficient way of allocating resources. By efficient, we mean that it maximizes the well being of society as a whole. We first formalize what this means.

Consumer Surplus

The demand curve represents consumers' willingness to pay for a certain quantity of a good. Imagine the market for bell peppers. Some people really value bell peppers and would be willing to pay a lot for 1 bell pepper, maybe as much as $100. Other people like bell peppers, but maybe prefer to eat pizza, and so would only be willing to pay $1 for a bell pepper. The market demand curve adds up the quantity demanded by all of the consumers at a given price. The market equilibrium occurs where that demand crosses supply.

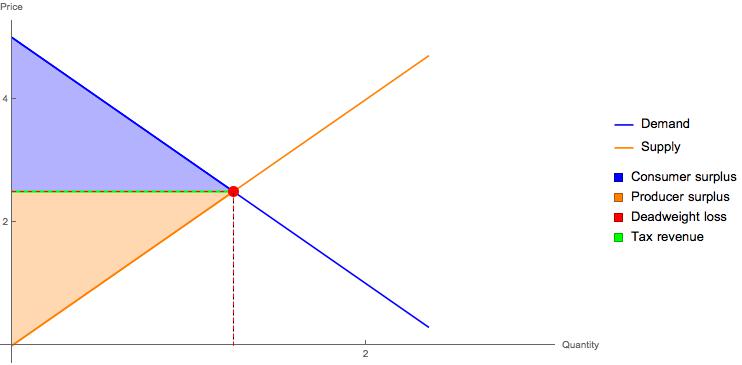

Since everyone in the market pays the same price that means some people are better off as a result. Suppose that in the bell pepper market the equilibrium price is $2. Then the people who are willing to pay $100 for the bell pepper come out ahead, by quite a bit. These consumers are willing to pay $98 more than they have to -- that difference between their willingness to pay and the equilibrium price is called consumer surplus. For those people who value it at $1, then they are not a part of the market and they don't have any surplus. Looking at the graph above, consumer surplus is the blue shaded area: it is the area in between the demand curve and the market price.

Consumer Surplus is the difference between what consumers' are willing to pay for a good and the market price of the good. Consumer surplus is represented graphically as the area below the demand curve and above the market price..

Producer Surplus

Just like how some consumers are willing to consume more at a given price, firms differ in their willingness to sell. Let's continue with the bell pepper market example. Some bell pepper farmers are more efficient than others -- perhaps they have a large farm and state-of-the-art farming equipment -- that allows them to produce bell peppers at a low marginal cost. These bell pepper farmers may be willing to supply thousands of bell peppers for $0.10 each. Other bell pepper farmers -- say, someone with a small backyard farm -- can produce only a few bell peppers at a much larger expense. Maybe these farmers are willing to supply a few bell peppers at $5 each. Each of these farmers will produce until price equals their marginal cost. The market supply curve represents how many bell peppers all of the farmers are willing to supply at a given price -- i.e. it represents their marginal cost curve of farmers. When the market equilibrium price is $2, then the efficient farmers benefit by $1.90, since they were willing to produce at $0.10. The least efficient farmers, however, choose not to enter the market. The difference between the market price and the producers' marginal cost is the producer surplus. In the graph, it is the orange area -- i.e. the area in between the market price and the supply curve.

Producer Surplus is the difference between producers' marginal costs and the market price of the good. Producer surplus is represented graphically as the area in between the market price and the supply curve.

Market Efficiency

The graph then illustrates why competitive markets lead to the maximizing social welfare. Social welfare is the sum of the surpluses realized by consumers and producers (also, governments which we will get to below). In the graph, it is represented by the sum of consumer surplus and producer surplus. That entire shaded area is social welfare and it is maximized at the market equilibrium. If the market sold more than the equilibrium quantity then there would be either consumers' consuming at a negative surplus (e.g. the consumers who value the good at only $1, but the market price is $2) or firms whose marginal cost is greater than the market price (e.g. the farmer whose marginal cost is $5 would be selling at a loss compared to the $2).

Taxes and Deadweight Losses

Now imagine a government that imposes a sales tax on a good. Recall from earlier that it does not matter who the tax is levied on, the tax incidence and the outcome in the market is independent of who actually pays the tax directly to the government. Here is a graph of the sales tax, with consumer and producer surplus shaded in.

In the graph, a $1 tax is imposed. This changes the market outcome to the black dashed line, there is a lower quantity, and the difference between what consumers pay and producers pay is the $1 vertical distance between the demand and supply curves.

The green shaded area is the tax revenue collected by the government. It is just the $1 tax (the green vertical area) times the quantity sold (the black dashed line). So tax times quantity equals the green shaded area. This tax revenue is counted as a benefit to society so it is included in our measure of social welfare.

Consumer surplus is again the blue shaded area. Notice, in comparison to the graph above, that consumer surplus is lower after the tax is imposed. Why? Consumers are paying more for fewer quantity of the good. There are consumers who were willing to pay $2.50 for the good but now are not consuming at the higher price.

Producer surplus is the orange shaded area and it is also smaller than it was before the sales tax. Why? Producers are receiving a lower price for their goods and selling fewer goods. There were firms that were willing to supply at the old market equilibrium price who are not willing to produce at the lower price. So, overall producer welfare is lower.

Now notice the red shaded triangle, labeled Deadweight Loss. This is the area that was part of consumer and producer surplus before that has been lost as the result of the tax. It represents a loss to society because it is those consumers who would like to consume at the market price, and those firms would like to supply it to those consumers at the market price, who cannot consume or produce. Society would be better off if trade could occur at the market equilibrium.

So the effect of a tax is to lower consumer and producer surplus. Some of that loss in surplus is a gain to the government via tax revenue (green shaded area). But, there is a portion of the loss of surplus that is just gone, and that is the deadweight loss of the tax.

This deadweight loss is the cost to society from whatever government program is being funded by the sales tax. When deciding whether to pursue a policy, policymakers should weigh the benefits of the program (for example, the benefit to society from having free public and compulsory education) against the costs of funding it.