Government Policies

This page describes the effects of two government policies that affect a market's equilibrium: price controls in the form of floors (e.g. minimum wages) and ceilings (e.g. rent control). An important takeaway is that the effects of these policies depend, in part, on how responsive the quantity demanded or supplied is to changes in price, a concept known as price elasticity.

Price Elasticity

In the figure above, the demand curve is relatively flat, while the supply curve appears relatively steep. The slope of these curves reflect how responsive consumers, or firms, are in the quantity they demand, or supply, when prices change. In this overview, we will first see how market equilibrium reacts to shifts when demand/supply are more or less elastic.

Price Controls

In the above graph, there is a price floor -- a government regulation that prices can not be lower than a prescribed level. The most common example of a price floor is a minimum wage. When the floor is above the equilibrium level, suppliers wish to provide more to the market at the artificially high price than buyers would like to buy, creating a surplus. The size of this surplus depends on price elasticity of supply and demand.

Sales Taxes

Governments raise revenue to finance spending programs by levying taxes. These could be sales taxes on, for example, hotel rooms. Or they could be payroll taxes on labor. Sales taxes distort the market equilibrium, with buyers paying more for a product and sellers receiving less. How the burden of paying the sales tax is distributed between buyers and sellers is called tax incidence, and it depends on price elasticity.

Price Elasticity

We begin with the definitions of price elasticity and how it is related to the slopes of the demand and supply curves.

Price Elasticity of Demand: measures how the quantity demanded of a particular good responds to a change in the price of that good.

Price Elasticity of Supply: measures how the quantity supplied of a particular good responds to a change in the price of that good.

For both price elasticity of demand and supply, it is computed as the percentage change in quantity demanded or supplied, respectively, divided by the percentage change in price. See Chapter 5 of the textbook for methods for calculating elasticity.

Demand is referred to as elastic if the price elasticity of demand is greater than one. In this case it means that the percentage change in quantity demanded changes by more than the percentage change in prices. For example, if a 10% increase in the price of bell peppers leads to a 20% decrease in the quantity demanded of bell peppers, then quantity demanded is very responsive to price changes and demand is described as elastic. In this example, the elasticity is 2. On the other hand, if the 10% increase in prices decreased quantity demanded by 5%, then the elasticity would be 1/2 and we would say that demand is inelastic. When quantity demanded is less responsive to price changes, the elasticity will be less than one, i.e. inelastic.

At this point in your understanding of supply and demand you should not be surprised that an increase in price decreases quantity demanded. Otherwise, you need to review Chapter 4 again. .

Similarly, whenever the supply elasticity is greater than one it is elastic and less than one it is inelastic.

There is a close connection between price elasticity and the slopes of the supply and demand curve. The textbook provides the following rule of thumb:

The flatter the demand (supply) curve that passes through a given point, the greater the price elasticity of demand (supply). The steeper the demand (supply) curve that passes through a given point, the smaller the price elasticity of demand (supply).

The following interactive graphic illustrates how change price elasticity of demand and/or supply affects the supply and demand graph.

Lecture Video on Elasticity Examples

Government Policy 1: Price Controls

A price control is a regulatory policy that dictates prices cannot be above or below a certain level set by law. There are two types of price controls:

- price floor: a price is not allowed to be charged below the price floor. The most common example is a minimum wage law which requires firms to pay a wage at least as high as the minimum wage (price floor).

- price ceiling: a price which is not allowed to be charged above the price ceiling. The most common example are rent control laws, which require landlords to charge rents that are below the rent control (price ceiling).

When evaluating the effects that price controls have on a market depends on whether the price control is binding or not. That is, if the market equilibrium wage is above the minimum wage, then it is not binding, and the law will have no effect on the market: firms were paying above the minimum wage already. Similarly, if the market equilibrium rent is below the ceiling, then it is not binding, and the law will have no effect: landlords were already charging rents below the legal rent control price.

However, when a price control is binding it creates either a surplus or shortage in the market. A binding minimum wage raises workers wages above the market equilibrium wage, i.e. where demand = supply. Since workers are paid a higher wage in this case they seek to supply more hours to firms. Conversely, since workers are paid a higher wage, according to the demand curve, firms will demand a lower quantity of worker hours. This creates a labor surplus, also known as unemployment. A binding rent control is the opposite situation, here renters would like a higher quantity of housing since prices are lower from the rent control law, but landlords will not supply as high a quantity of housing. This creates a shortage in the market.

Video on Price Floors

Use the following interactive graphics to see the effect price controls have on the market.

Interactive Graph: Price Floor

Video on Price Ceilings

Interactive Graph: Price Ceiling

Government Policy II: Sales Taxes

A sales tax is a per-unit tax on a good. Economists differentiate between who literally pays the government the tax and the economic burden of the tax.

Tax incidence: how the burden of a tax is shared between buyers and sellers. .

The big take-away from this section of the course is:

The tax incidence does not depend on who actually pays the tax to the government. The incidence depends on the relative elasticity of demand compared to supply. .

The logic for this take-away is as follows.

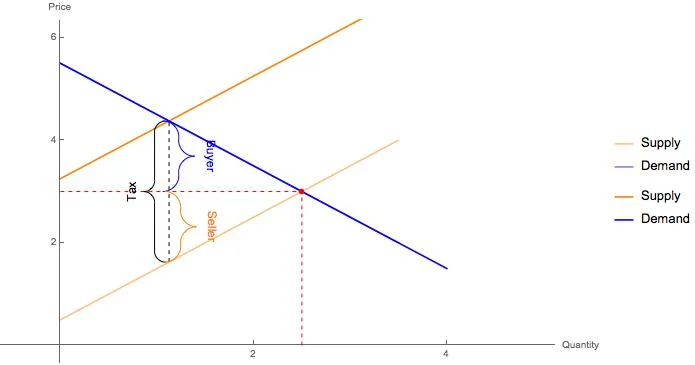

- When the sellers pays the tax, then for any price they receive for their products they get to keep the price - tax.

- Therefore, the supply curve shifts up by the amount of the tax (see graph below). This is because they now need price + tax to produce the same amount as before.

- The tax incidence for the seller is the difference between the pre-tax equilibrium price (the red dot in the graph below) and the post-tax amount they receive. In the graph, this incidence is marked as "Seller".

- For the buyer, they now pay the higher price (where the new supply curve crosses the demand curve). The tax incidence for the buyer is the difference between the post-tax equilibrium price and the pre-tax equilibrium price. In the graph, this incidence is marked as "Buyer".

So what about when the buyer pays the tax? How does this affect incidence?

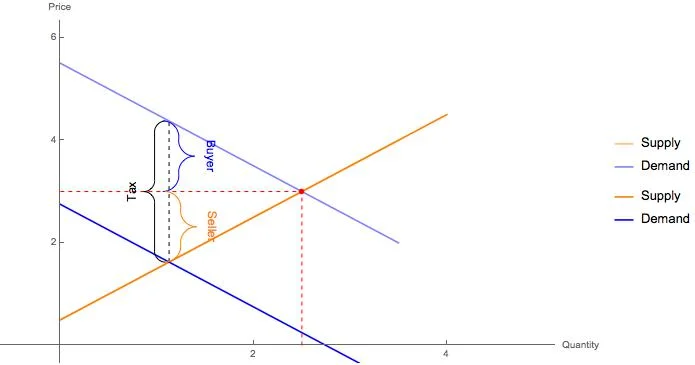

- For the buyer, now at any given price for the tax they actually pay the price+tax.

- Therefore, the demand curve shifts down by the amount of the tax (see graph below).

- Notice in comparing the two graphs that the incidence is the same for buyers and sellers.

- It does not matter who physically pays the tax to the government, economically they share the burden in the same way.

Since tax incidence does not depend on whether the buyer or seller physically pays the tax, when graphing the effects of a sales tax it is typical to ignore who pays the tax (i.e. whether it is a shift in the demand or supply) and focus just on the tax incidence.

If the economic burdens of a tax are shared by buyers and sellers independently of who pays the tax, what determines tax incidence? The answer is the relative elasticities of demand and supply, with the burden being higher on the side of the market with the more inelastic curve.

For example, if demand is very inelastic compared to supply, then it means that demand is not very responsive to price. So when a tax is imposed, the price paid by buyers increases a lot compared to sellers, so the buyer bears the heavier burden of the tax.

Conversely, if supply is very inelastic compared to demand, then supply is not very responsive to price. A sales tax will decrease the price received by sellers much more than increase for buyers: the seller bears the heavier burden of the tax.

Not convinced? Use the interactive graphic below, to alter the size of the tax (how are burdens changed?) for different elasticities of supply and demand.

Minimum Wage Debate

The basic supply-demand model of a perfectly competitive market makes very clear predictions about the effect of raising the minimum wage: it creates a shortage of jobs, i.e. unemployment, while raising the incomes of those workers who have jobs at the higher minimum wage. This basic model sets up a tension between insiders (who have jobs) and outsiders (who are unable to work as much as they'd like at the minimum wage).

But, economists and policymakers have engaged in heated debate about the effects of minimum wages for decades. Depending on the elasticities of supply and demand, the unemployment effects might be small. Depending on how competitive industries are the effect of minimum wages could be higher prices for goods. But, if the labor market is not perfectly competitive it could also be the case that higher minimum wages will increase the number of jobs. The argument goes that with a higher minimum wage higher skilled workers are pulled into the labor force, and those with jobs may work harder given the higher incomes they are receiving. Economists who have studied the effects of minimum wages find a range of estimates, from small negative effects of a higher minimum wages on the amount of employment, to zero to a slightly positive effect.

Against this backdrop, the following video puts a human touch on the debate between proponents and opponents of higher minimum wages set against the backdrop of Seattle's law to raise the minimum wage to $15/hour.